Lower retained earnings makes a company more attractive to investors. It represents the investments by stockholders in a company.

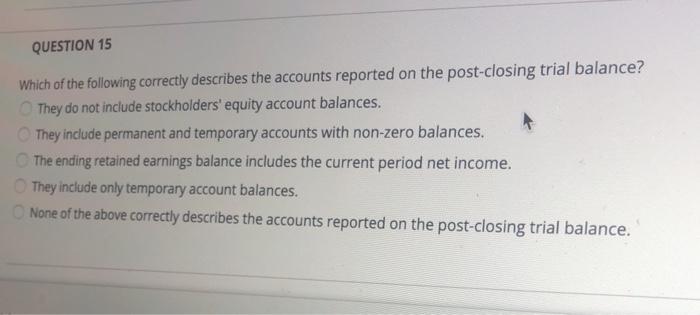

Solved Question 15 Which Of The Following Correctly Chegg Com

Income that has been reinvested in the business rather than distributed as dividends to stockholders.

. It is the cumulative earnings of a company less dividends declared. Liabilities are not affected b. A cash payment is made to pay the taxes due.

Retained earnings increases D. The first line contains your business name. Which of the following correctly describes globalization 2 See answers Advertisement Advertisement duhari610 duhari610.

Question 6 Which of the following correctly describes retained earnings. It is the cumulative net income of a company less dividend declarations. A cash payment is made to pay the taxes due c.

The following correctly describes the effect on the financial statements. Which of the following correctly describes retained earnings. A It is the cumulative earnings of a company.

Which of the following correctly describes the. Retained earnings shows the amount of funds retained in the business since it began b. Which of the following correctly describes a general ledger.

Retained earnings decreases QUESTION 32 Match each account name below with the appropriate type of account. Which of the following correctly describes the effects of accruing income tax expense at year-end. Multiple Choice Retained earnings decreases.

The change in the cash balance on the statement of cash flows added to the beginning cash balance equals the ending cash balance. It equals total assets minus total liabilities. It equals total assets minus total liabilities.

Intangible assets are generally current assets. D It represents the investments by stockholders in a company. Revenues are increased B.

Which of the following correctly describes the effects of accruing income tax expense at year-end. The entry decreases assets and decreases net income. Retained earnings is the leftover of net income after dividend payment.

Which of the following correctly describes retained earnings. Retained earnings is the leftover of net income after dividend payment. A debit to additional paid-in capital and a.

C a correction of prior years errors. During 2016 Miller reported net income of 1500000 declared dividends of 500000 and issued common stock for 1000000. 48 Which of the following correctly describes retained earnings.

Multiple Choice It is the cumulative earnings of a company. Cash available for dividends. See full answer below.

Which of the following is true about retained earnings. Since the retained earnings are the part of profit which is retained by the firm and not distributed to the shareholders in the form of dividend. Multiple Choice Retained earnings decreases.

Liabilities are not affected. CNet income Revenues - Expenses. Which of the following correctly describes retained earnings.

Lower retained earnings makes a company more attractive to investors. 4Which of the following correctly describes the effects of initially recording prepaid insurance expense when cash is paid to purchase an insurance policy. It is not a liability for the firm as it increases the amount of owners equity and thus reported in the shareholders equity section of balance sheet.

Liabilities are not affected C. It represents the investments by stockholders in a company. Higher retained earnings means investors receive lower dividends.

Liabilities are not affected. A the single-step and the two-step methods. D - Retained earnings are the cumulative profits not distributed to investors.

A debit to retained earnings and a credit to dividends payable. Stockholders Equity Goodwill 120000 Common Stock 100000 Trade Names 201700 Retained Earnings 200000 Total Intangible Assets 321700 Total Stockholders Equity 300000 Total Assets 712500 Total Liability amp. Which of the following correctly describes the two basic methods to present a companys statement of income.

It is the cumulative net income of a company less dividend declarations. Higher retained earnings means investors receive higher dividends. Which of the following correctly describes the effects of accruing income tax expense at year-end.

The ending retained earnings balance is reported on the balance sheet D. Lower retained earnings cause a decrease in the stock price. It is the cumulative net income of a company.

It equals total assets minus total liabilities. Which of the following best describes retained earnings. Total assets do not change.

Which appears first in a statement of retained earnings. It represents the investments by stockholders in a company. B It equals total assets minus total liabilities.

Which of the following correctly describes the effects of recording deferred revenues when cash is received from a customer in advance of the services to be provided. Higher retained earnings means investors receive lower dividends. The statement of retained earnings would not include a distributions of earnings for dividends.

Retained earnings Net Income Dividends. Liabilities are not affected. 13 Which of the following is true about retained earnings.

Net income increases d. Higher retained earnings means investors receive higher dividends. Asked Oct 3 2016 in Business by Jentoy.

The entry increases expenses and decreases retained earnings. Assets can be tangible or intangible c. Cash available for expansion and growth.

Answer It is the cumulative net income of a company. Which of the following correctly describes the recording of a dividend declaration by a companys board of directors. It represents the investments by stockholders in a company.

On January 1 2016 Miller Corporation had retained earnings of 8000000. The second line is the document. The amount initially invested in the business by stockholders.

It is the cumulative earnings of a company B. C It is the cumulative earnings of a company less dividends declared. Lower retained earnings cause a decrease in the stock price.

The answer is B. It represents the investments by stockholders in a company. Group of answer choices An index of all the financial accounts reported in the financial statements A summary record of each separate asset liability owners equity revenue expense and dividend accounts.

The answer is B. B the effect of changes in estimates. A debit to retained earnings and a credit to cash.

It represents the investments. Net income is not affected. A cash payment is made to pay the taxes due.

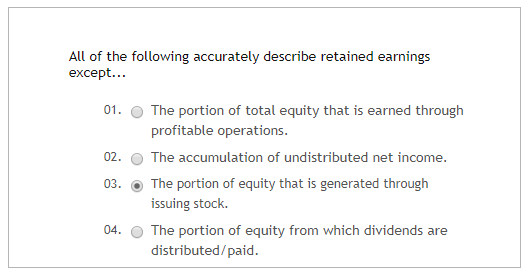

Solved All Of The Following Accurately Describe Retained Chegg Com

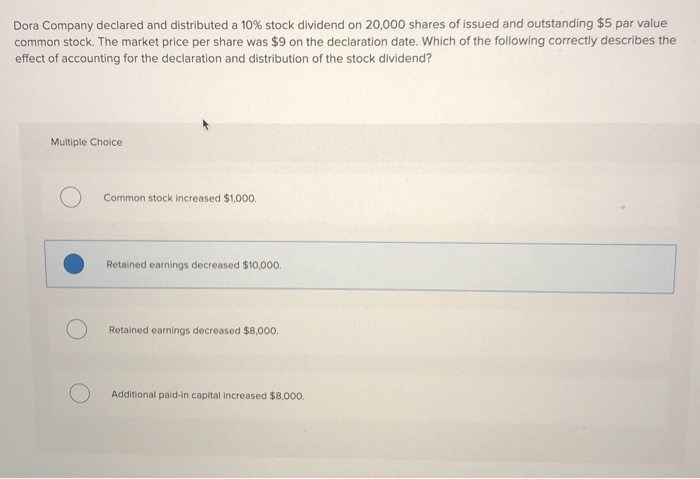

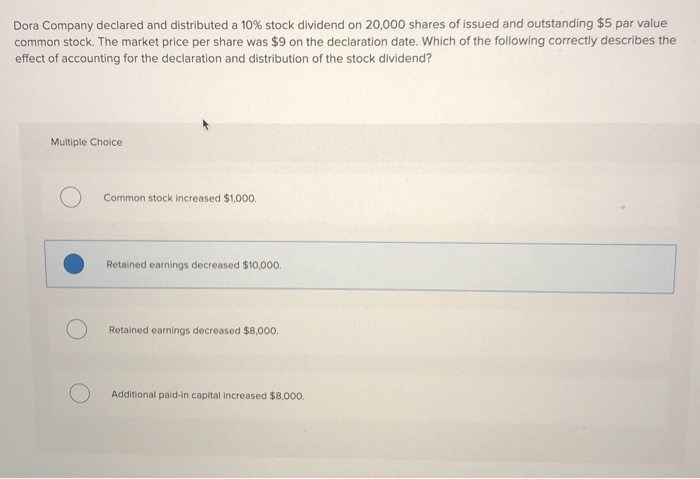

Solved Dora Company Declared And Distributed A 10 Stock Chegg Com

Question 6 Which Of The Following Correctly Describes Retained Earnings Answer Course Hero

0 Comments